8 Member Survey Mistakes NRL Clubs Make (And How to Avoid Them)

5 Nov 2024

Member surveys are a double-edged sword - they offer invaluable insights into the member experience but can damage engagement when done poorly. Here are the most common mistakes NRL clubs make, and how to avoid them.

At the start of the 2024 NRL season I joined every club to compare the experience of becoming a member for the first time. This is part three in a series of observations about this experience.

—

Member surveys are an essential tool for gathering feedback and insights. While creating and distributing surveys has never been easier - there are hundreds of apps available to help (and my favourite is Fillout - affiliate link) - creating a good survey remains challenging.

What makes a good member survey? At its core, it should capture accurate, actionable intelligence while respecting members' time and trust. This balance isn't easy to achieve, as I discovered during my review of NRL club surveys.

Let's start with the landscape of member surveying across the league. Only 65% of clubs surveyed members about their membership experience, with some clubs focusing on unrelated topics and nearly a quarter not surveying at all.

11 of the 17 clubs sent a survey about the membership experience

2 clubs sent surveys on other topics (e.g. likelihood to go to Las Vegas, thoughts on future fixtures), but not about membership

9 clubs provided an incentive to complete the survey, most commonly offering a "win a 2024 signed jersey" prize

4 clubs (nearly one quarter) didn't send a survey at all

8 mistakes NRL clubs make with their member surveys

Here are the eight most common mistakes I observed in NRL club member surveys, along with practical solutions to fix them. While some clubs did better than others, every club has room for improvement in how they gather member feedback. These mistakes not only reduce the quality of insights clubs receive, but can also frustrate members and damage engagement.

Surveying too early

In the first week of April I received my first member survey of the season. This survey asked the question “What has been your favourite membership experience?” I had only joined two weeks prior so I had very little experience to provide feedback on. Seven of the eleven clubs that surveyed their members did so in June or earlier, missing out on insights from the season as a whole.

How to fix this: Send multiple, shorter surveys throughout the season. For example, one survey when members join or rejoin, a pulse check midway through the season and one at the end of the season.

Why this matters: Early surveys only capture initial impressions, missing how members experience game days, club communications, and member benefits throughout the season. This incomplete picture can lead to misguided program improvements and ignore seasonal pain points.

Asking too many questions

Some surveys were epic in length. The longest asked 107 questions, while one club asked 21 separate questions about sponsors.

When a survey is too long, one of two things happen (and neither are good):

people abandon the survey (and the club misses out on their feedback), or

people rush their answers in order to finish (and the responses are therefore unreliable).

The average length of an NRL survey was 61 questions - more than double the recommended maximum of 30 questions.. While some respondents will continue to the end, a survey that long is going to lose members along the way and the higher the dropout rate, the less useful the results.

How to fix this: Survey completion rates drop significantly after 7-8 minutes. Depending on the complexity of the questions, this means that there should be a maximum of 30 questions per survey.

Why this matters: Long surveys don't just irritate members - they create unreliable data. When you force members to wade through 100+ questions, you're more likely to get rushed, thoughtless responses from those who persist and miss feedback entirely from those who abandon the survey.

Not segmenting members

All members are not alike. The expectations of a first-time member are different to those who have been part of the club for 50 years. The experience of a member who attended every season in a catered corporate box will be different to those who attended once and sat in General Admission.

If you don't segment your membership you won't understand the differences in needs based on different member types and experiences. Without segmentation, you risk lumping together feedback from vastly different member groups, leading to insights that don't accurately represent any single group's experience.

No club asked how long I had been a member of the club. Yet the responses would be interpreted differently based on the length of tenure.

How to fix this: Add two questions to the survey:

"How long have you been a member of [Club]?"

"Which membership package did you purchase this year?"

Why this matters: Without segmentation, you risk making decisions based on averages that don't represent any actual member group. A corporate box member's feedback on game day experience is fundamentally different from a general admission member's - mixing these together dilutes the value of both.

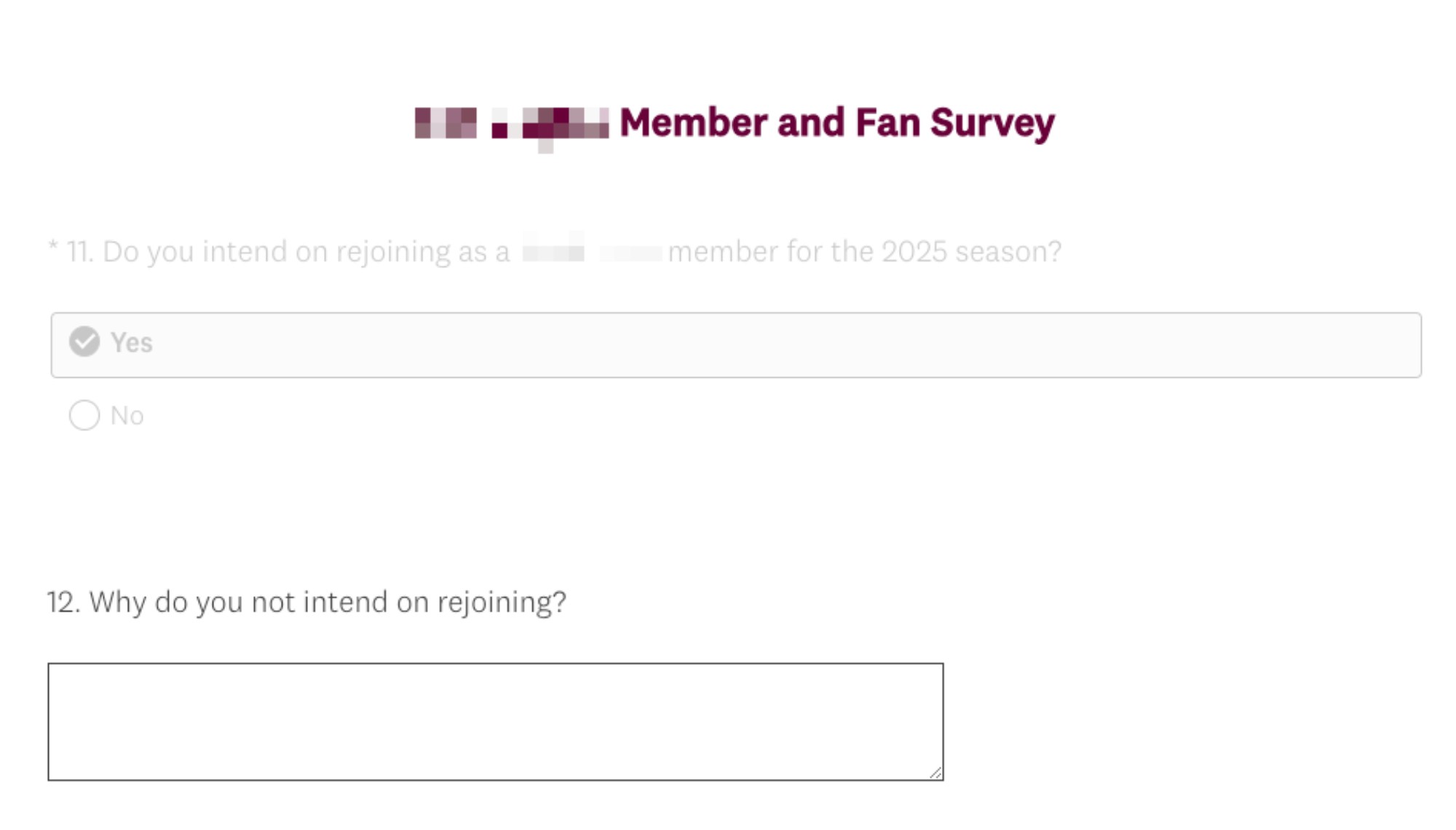

Not using logic

If a question isn’t relevant, it shouldn’t be asked. For example, in one survey I said that I intended on rejoining in 2025 but the following question asked “why do you not intend on rejoining?” I was so confused I went back and rechecked my previous answer! This isn’t just a wasted question, it risks annoying the member.

How to fix this: Use conditional logic to create forms that adapt and adjust based on a respondent's input.

Why this matters: Irrelevant questions don't just waste time - they damage credibility. When members encounter questions that don't apply to them, they question whether the club understands them at all and may doubt the value of providing feedback.

Want to get your member surveys right? Subscribe to the free email Growth Insights (link below) and receive The Ultimate Member Survey Checklist for NRL Clubs.

Getting too personal

How would you feel being asked these questions?

What is your household income?

Have you purchased a property in the last 12 months?

What brand of car do you drive?

How much do you typically budget for home improvements?

How do you manage your banking?

What social causes/charities do you support?

It’s a fine line between learning more about your members and your members feeling interrogated. It’s worth noting that NRL clubs were not as bad as the questions I was asked after attending an AFL match. For example:

“Taking into account all cash, EFTPOS, credit cards and cheques can you please tell us how much money was spent because of your attendance.”

“How much did you personally spend on the following items (from the time you left home to the time you returned home)?”

“Approximately what would be your total household income per annum before tax?”

How to fix this: If you’re going to ask questions like these, you need to explain clearly why you’re asking and what you intend to do with this information.

Why this matters: Trust is fragile. When members feel their privacy is being invaded without clear purpose, they're not just less likely to complete the survey - they're less likely to engage with future club communications and initiatives.

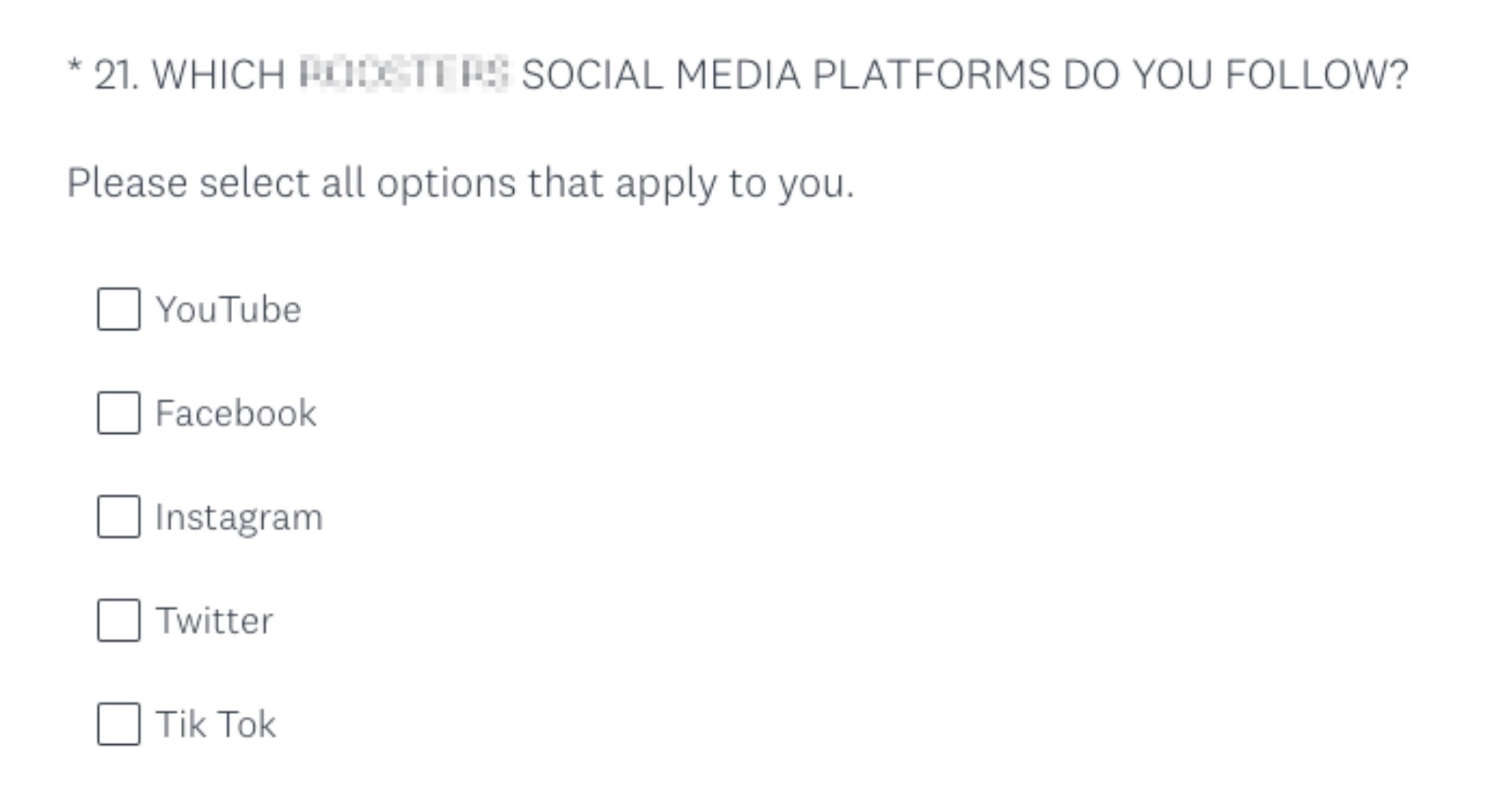

Making questions mandatory

The question below was a required question - I couldn’t proceed to the next question without answering it. The problem is, I don’t follow the club on any of these social media platforms. So which option should I choose?

A mandatory question is a dangerous question. When people (like me) are forced to pick an option in order to continue the survey, none of the responses to that question are going to be reliable.

How to fix this: Use mandatory or required questions sparingly, and always provide an N/A or Other option to avoid forcing members to provide a response in order to proceed.

Why this matters: Forced responses create false data. When members have to pick an answer just to proceed, you're not gathering insights - you're gathering guesses. These unreliable responses can lead to misguided business decisions.

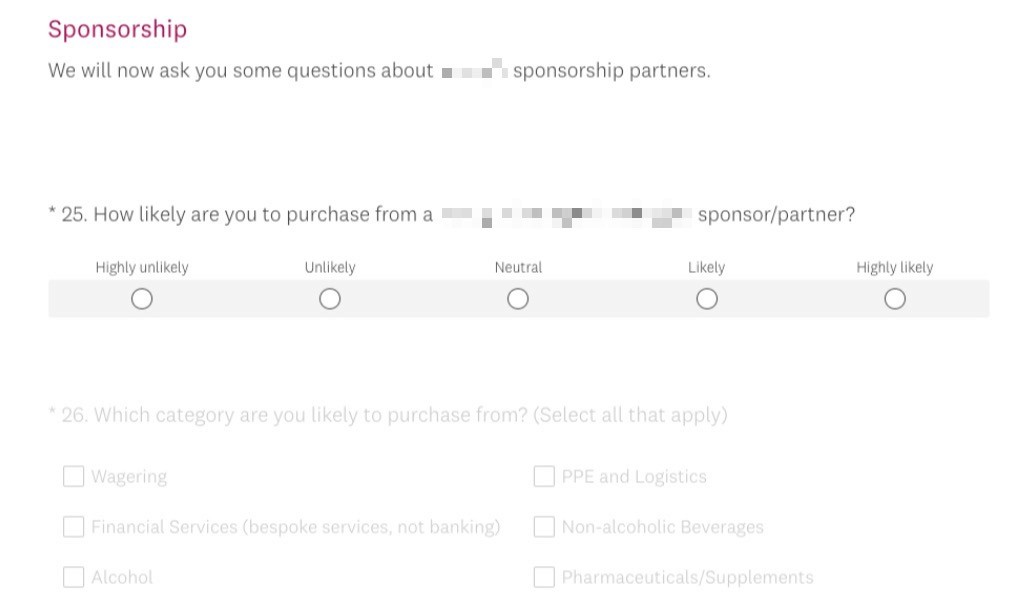

Asking unanswerable questions

Asking mandatory questions often leads to unreliable responses and so does asking questions that are impossible to answer. There are two types of questions in this category. Firstly, questions that I am not qualified to answer. For example, several clubs asked:

“How would you rate the club’s performance on communication with key stakeholders (e.g. Members, media, government)?”

I only received communications as a member. How can I comment on the club’s performance when it comes to communicating with the media or government? Other examples:

“How satisfied are you with the administration of the club?” and

“How satisfied are you with the functioning of the board?”.

How would I know? Even the common question “Rate the customer service of the membership team” is difficult to answer if I didn’t have any interaction with the membership team. This question is better asked after confirming I had interacted with the membership team or even better, asked immediately after an interaction with the membership team.

The second category is the ambiguously worded question. Without precise wording, a question can be interpreted in different ways making the responses unusable. For example:

“Overall, how satisfied are you with the involvement you feel with the [Club]?”

What does “the involvement I feel” mean? Should this have been “how satisfied are you with your level of involvement with the club?” Here’s another:

The only answer to this question is “it depends”. I would guess that the intention of this question was to understand if I would be more likely to purchase from club partners than from other service providers (see the Rabbitoh’s more clearly worded question below), but it’s not clear.

How to fix this: Test the survey with multiple people before sending it out and ask these people to identify any questions they didn’t understand.

Why this matters: Asking members to evaluate things beyond their experience undermines survey credibility and reduces future response rates. Bad questions don't just produce meaningless data - they damage member trust.

Not asking about renewal intentions

Members will have different opinions about the team’s performance, whether they prefer a cap or a beanie and if they’ve heard about the club’s Foundation. When all is said and done, the most valuable insight is:

“How likely are you to renew your membership next season?”

I was surprised that no club asked this question. The closest was the Bulldogs who asked:

How to fix this: Set clear objectives for the survey and ensure that the most important questions are asked.

Why this matters: Renewal intention is the ultimate measure of member satisfaction and a key predictor of future revenue. Without this data point, clubs miss the opportunity to identify at-risk members and address their concerns before they leave.

Moving Forward: Building Better Member Surveys

While every club took a different approach to member surveys - from delivery method to user experience features like progress bars and edit options - none got it completely right. This isn't surprising. The NRL's strength lies in giving clubs autonomy over member engagement, but with this freedom comes the opportunity to learn from each other.

By developing best practices for member surveys, clubs can:

Respect member time with focused, relevant questions

Capture actionable insights through proper timing and segmentation

Build trust through thoughtful data collection

Drive real improvements in the member experience

Want to get your member surveys right? Subscribe to the free email Growth Insights (link below) and receive The Ultimate Member Survey Checklist for NRL Clubs.